Delegated Proof-of-Stake (dPOS) and Leased Proof-of-Stake (lPOS)

What is Leased Proof of Stake

Leased Proof of Stake operates on the principle that literally everyone can win the chance to add a block to the blockchain, by using a system not much unlike a lottery which can be participated in using leased coins.

In classic Proof of Stake, holders with low amounts of coins are unlikely to ever get the chance to add a block — just as small miners with low hashrate are unlikely to mine a block in bitcoin, using Proof of Work. In fact, it may be many years before a small holder is lucky enough to win.

This means that many holders with low amounts of coins will never actively partake in the network, so maintaining it is left to a limited number of larger players, which inadvertently creates unwanted centralization and possible 51% attack.

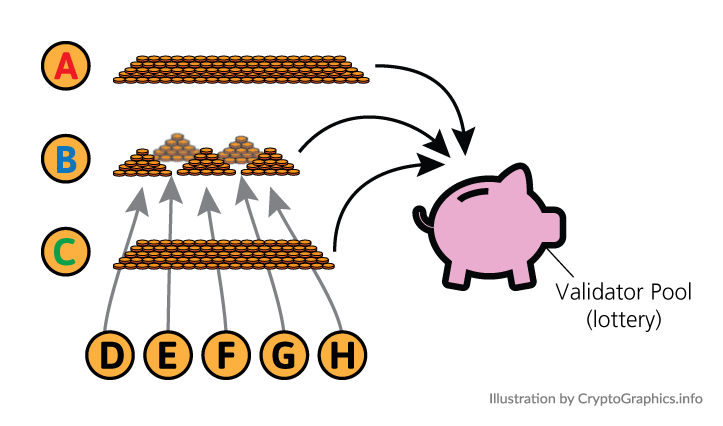

Leased Proof of Stake works exactly like PoS, but uses leasing to provide small holders with an incentive to take part. The low holding nodes (D, E, F, G, H) lease their balance to a staking node (B), while the leased funds remain in full control of the holder.

The leased coins increase the staking node’s stake, in turn increasing its chance of winning the ‘lottery’. Upon winning, the staking node collects waiting transactions into a block and collects the transaction fees, which are shared – proportionally – between the staking node and its leasing nodes and operation resumes as in regular Proof of Stake.

Delegated Proof of Stake

Delegated Proof of Stake (DPoS) is a blockchain consensus mechanism in which users who hold that blockchain’s coin are able to vote for “delegates.”

It is very similar to the leased version, but differs on one important aspect: with dPoS, coin holders use their balances to elect a list of nodes, regardless of their balance, that will have the opportunity to take part in the ‘lottery’. This engages all coin holders, though it does not reward them directly in the same way as LPoS does.

All nodes in the network elect a group of nodes to partake in a ‘lottery’. Votes from nodes with a higher balance will have more weight in the election. Holders can also vote on changes to network parameters, giving them greater influence and ownership over the network.

The elected nodes partake in the ‘lottery’, on equal chances with the lottery’s prize to collect waiting transactions into a block and collect the transaction fees. Just as in regular Proof of Stake, the winning node provides the new block with a reference to the preceding block and then broadcasts it to all other nodes, which will then verify the transactions inside and add the block to their copy of the blockchain, with a re-election is held for the next block.

Rich get richer vs Nothing at stake

The mechanics of both delegated and leased Proof of Stake are similar to Proof of Stake in that both require users to stake coins as a means of participating in consensus. The main difference is that, in a dPoS and lPoS network, all coin holders, even the smallest ones, can participate in validation and decision-making through staking.

Contrary, Proof of Stake (PoS) systems are encouraging "rich get richer" model and rather than encouraging decentralization, they're encouraging re-centralization.

This is happening in two ways. The first is requiring a PoS validator to hold a large number of assets to even BECOME a validator in the first place.

Then, these systems reward validators proportionally, based on the amount of assets they hold. The more assets a validator holds, the more rewards they receive.

Staking’s supporters often cite the need for validators to have “skin in the game.” The argument goes that the more skin a validator has in the game, the less likely the validator is to manipulate the network.

This argument carries some weight. However, at a certain point, it becomes a paradox. More skin means more stake. So skin accumulation works against decentralization.

Furthermore, relying too heavily on the skin in the game argument provides cover for larger operators who use it to accumulate huge and disproportionate stakes. They do this while simultaneously claiming to be supporters of decentralization.

On the other hand, both delegated and leased version open a potential "nothing at stake" vector, where validators can act as bad actors and compromise the network with little to lose - which is a huge security risk and used often by the Proof of Work supporters against the staking.

Conclusion

Recognizing that staking is in its infancy, you may wonder if stake will ever decentralize. I don’t believe it’s too late. I do believe it’s possible for stake to decentralize over time.

Yet changes are needed for that to happen. When one thinks about these changes, it's interesting to wonder what catalyst is required to start elevating this issue to levels that encourage staking economy participants to take real action.

Human nature dictates that as long as prices keep rising, income remains passive and there are no unpleasant shocks to the system, the staking economy will keep humming along, while stake continues to centralize, weakening the economies’ foundations as a result.

Time will tell, which consensus mechanism will prevail.

Comments

Post a Comment